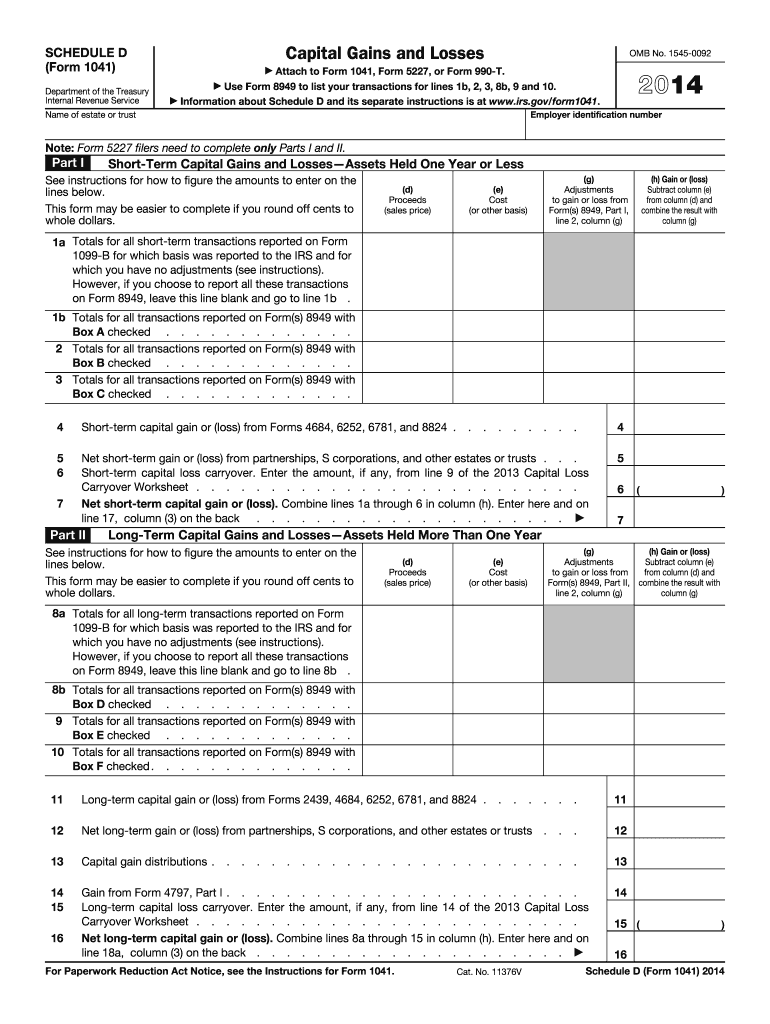

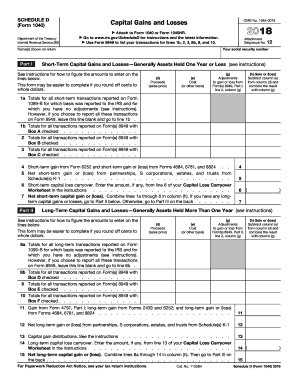

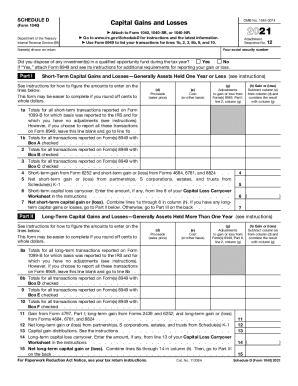

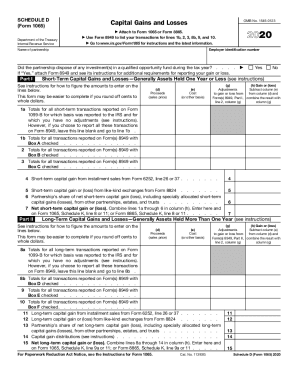

Irs 2025 Schedule D Form – Crypto losses or gains are reported on your personal tax form like any other capital gains tax, including options to offset a tax liability. . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

Irs 2025 Schedule D Form When Is Schedule D (Form 1040) Required?: The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2025 tax season is the elimination of the Form 1040EZ. Taxpayers who previously .