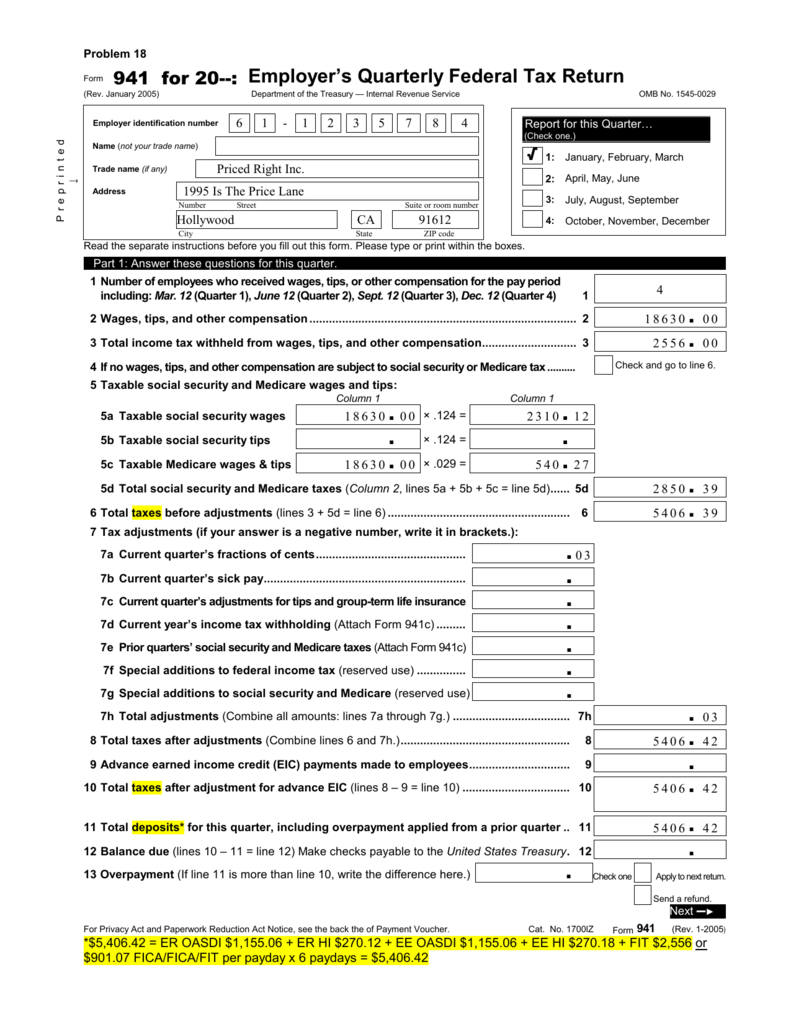

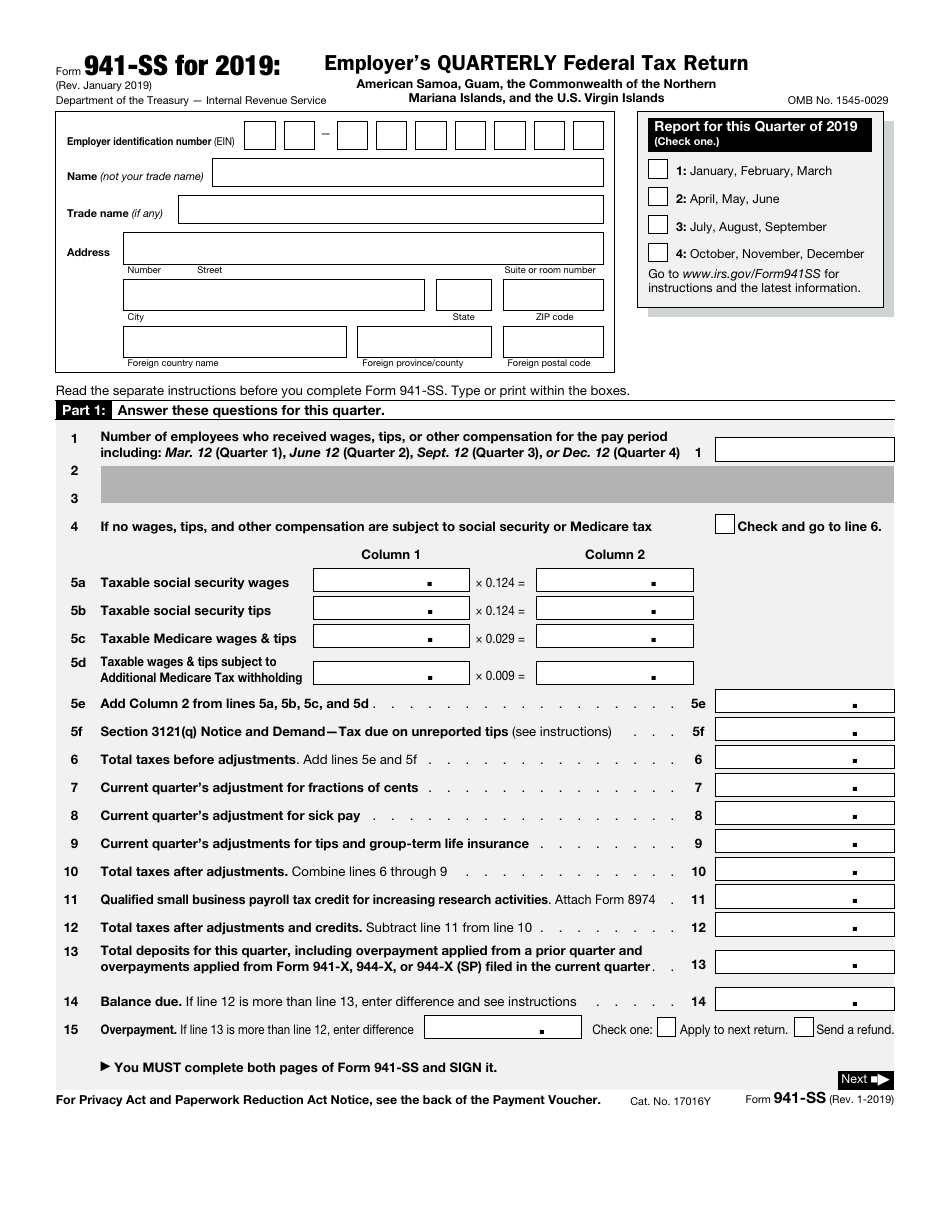

3rd Quarter 2025 941 Form. Irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Enter your tax liability by month schedule b is divided into the 3 months that make up a quarter of a year.

Filing deadlines are in april, july, october and january. Schedule b, report of tax liability for semiweekly schedule depositors;

941 Form 2025 Pdf Address Adda Livvie, As an employer, you must use form 941 to report the total amount of taxes you withheld from employees’ paychecks during the quarter.

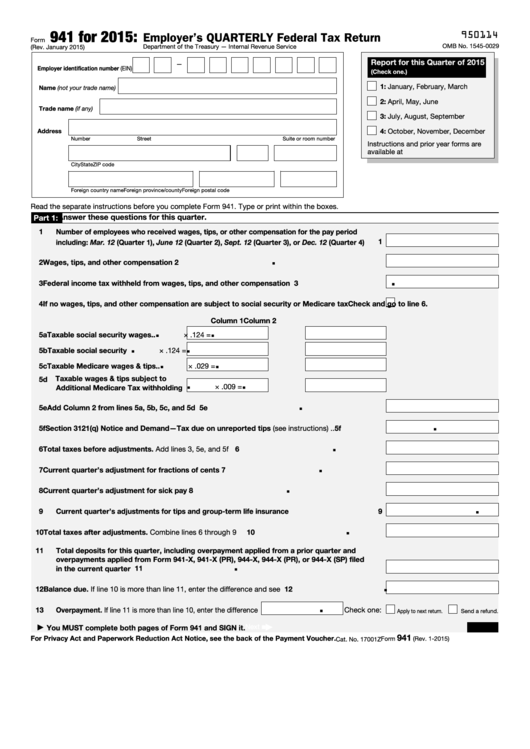

Form 941 2025 Pdf Download Free Dora Nancee, The final release included form 941, employer’s quarterly federal tax return;

3rd Quarter 2025 941 Form Patsy Willetta, Filing deadlines are in april, july, october and january.

3rd Quarter 2025 941 Form 2025 Dody Nadine, For the tax year 2025, the form 941 filing deadlines are:

3rd Quarter 2025 941 Form Pdf Alanah Marlie, Tax year 2025 guide to the employer's quarterly federal tax form 941.

3rd Quarter 2025 941 Form Lauri Annalise, In most cases, you’ll be able to skip filing the form if you have seasonal employees and don’t pay wages during a quarter, or if you employ household or agricultural workers.

3rd Quarter 2025 941 Form Pdf Maggi Yasmin, We are breaking down step by step how to easily file form 941 for the third quarter of 2025 with taxbandits!