2025 Tax Tables For Married Couples. The standard deduction rises to $15,000 for 2025, an increase of $400. * 37% for incomes over $626,350 ($751,600 for married couples filing jointly);

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). Calculate your personal tax rate based on your adjusted gross income for the 2025 tax year.

2025 Tax Brackets Married Filing Separately Married Virginia Bell, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly).

Irs 2025 Tax Brackets Married Jointly April Brietta, Your bracket depends on your taxable income and filing status.

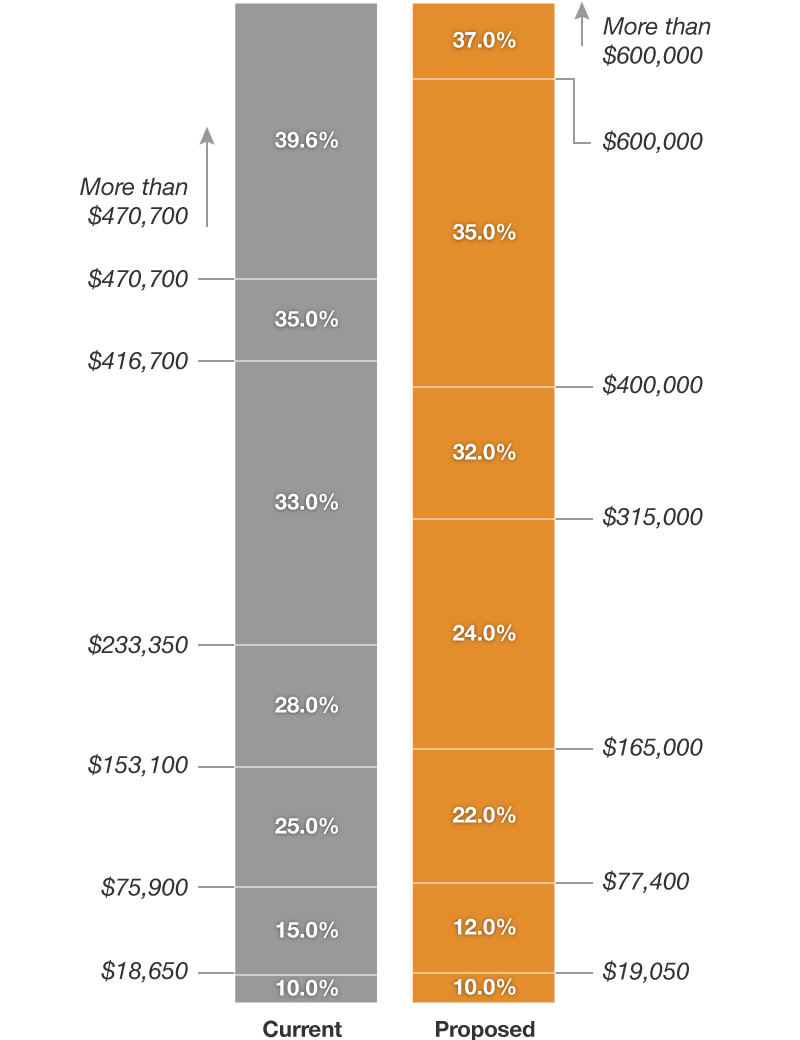

2025 Us Tax Brackets Married Filing Jointly App Vevay Jennifer, The federal income tax has seven tax rates in 2025:

2025 Tax Brackets And Standard Deduction Married Filing Jointly Mel, The federal income tax has seven tax rates in 2025:

2025 Tax Brackets Married Jointly Calculator Ibbie Melody, 2025 alternative minimum tax (amt) exemptions

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Staying updated about these adjustments will.

Tax Brackets For 2025 Tax Year Married Jointly Amie Harmonie, For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025.

Federal Tax Tables 2025 Married Filing Jointly Cordy Zilvia, The qcd limits are published in notice.

2025 Tax Brackets Australia Married Jointly Fanni Jeannie, For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025.